Who knew you could use your BTC as collateral?

We watched Luis’ latest Drawing Board episode on YouTube and decided to dissect it for our readers. Luis addresses a common looming problem for BTC holders: for true believers that have held BTC for a long time, selling it to buy products seem like a waste of money, when in fact it may serve as a retirement plan, assuming the markets follow suite.

Luis has found a way around this — by using his BTC as collateral, and not selling it.

Imagine buying a brand-new Tesla — without ever cashing out your Bitcoin. That’s exactly what Luis did when he purchased his second Tesla, a 2025 Model Y, using a Bitcoin-backed loan through decentralized finance (DeFi).

Here’s how he pulled it off — and how you can use the same strategy to fund big purchases without giving up your crypto.

Why Luis didn’t want to sell his BTC

Luis had been holding Bitcoin for nearly a decade. Like many long-term believers, he wanted to keep his Bitcoin rather than sell it, especially with its potential to appreciate even more over time.

In his view, the biggest way people “lose” their Bitcoin is by selling it too early. He needed cash, but didn’t want to part with his valuable holdings — so he looked for another option.

That’s when he turned to DeFi.

The Problem: tight deadlines, holiday closures, and traditional bank hassles

Timing was critical. Luis found out a limited-edition Tesla Model Y was available, but he had less than two weeks to secure about ₱2.5 million ($47,000).

To make things more complicated:

- It was Holy Week in the Philippines — banks were closed.

- Luis was in the U.S., far from his home banks.

- Traditional bank loans would require tedious credit investigations, employment verification, references, and possibly a 20% down payment.

In short: There was no way traditional banking could move fast enough.

The Solution: a BTC-backed loan through DeFi

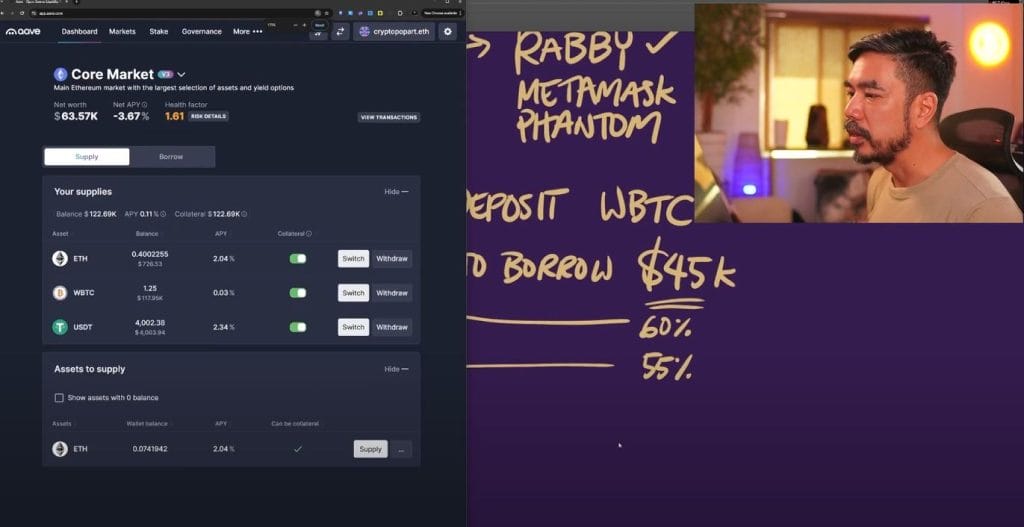

Luis turned to Aave, a leading decentralized finance protocol, to get the money he needed — fast.

Here’s the step-by-step process he used:

- Wrap Bitcoin (WBTC):

Bitcoin doesn’t natively work with most DeFi apps on Ethereum. So Luis converted his Bitcoin into Wrapped Bitcoin (WBTC), a tokenized version of Bitcoin compatible with Ethereum. He used Binance to swap BTC to WBTC, experiencing almost zero exchange loss. - Move WBTC to a Decentralized Wallet:

After converting, he moved his WBTC into a decentralized wallet (he used Rabby, but wallets like MetaMask work too). - Deposit WBTC on Aave:

He then deposited his WBTC as collateral on Aave. Aave let him borrow against it — he initially posted about 1 BTC (valued around $82,000 at the time) and borrowed roughly $45,000, keeping a safe loan-to-value (LTV) ratio to avoid the risk of liquidation. - Borrow and Convert to Cash:

Aave issued him a loan almost instantly in stablecoins (crypto versions of USD). He then converted the stablecoins to pesos and had the money deposited into his bank account — all within the same day. - Buy the Tesla.

With cash in hand, he closed the deal on the Tesla.

Why DeFi made sense in this case

Luis shared several reasons why borrowing against Bitcoin through DeFi was superior to using a bank:

- No credit checks, no paperwork:

The loan was “permissionless” — based solely on the collateral he posted. - Incredible speed:

It took 2 minutes to finalize the loan and just hours to get cash in hand. - Flexible repayment terms:

There’s no fixed schedule. Luis can pay back the loan whenever he wants, partially or fully, without penalties. - Lower interest rate:

The loan had a dynamic interest rate, ranging from 3.9% to 4.18% — lower than traditional car loan rates. - Preserve Bitcoin holdings:

Luis continued holding Bitcoin for the long term while accessing liquidity.

NOTE WELL (!!!)

Luis also emphasized a few key points of caution:

- Maintain a safe Loan-to-Value (LTV) ratio:

If the price of Bitcoin drops too much, your collateral can be liquidated. It’s safer to borrow less than 50–60% of the value of your Bitcoin. - Understand WBTC risks:

WBTC relies on a custodian to hold real Bitcoin. While convenient, this adds a layer of centralization some crypto purists dislike. - Monitor dynamic interest rates:

Rates can go up or down depending on market demand.

Luis’s experience shows how DeFi loans open up new ways to unlock the value of your crypto without selling it — whether it’s to buy a Tesla, invest in real estate, or cover urgent expenses.

As long as you understand the risks and manage your loans carefully, borrowing against your Bitcoin could be a powerful financial tool for long-term holders.