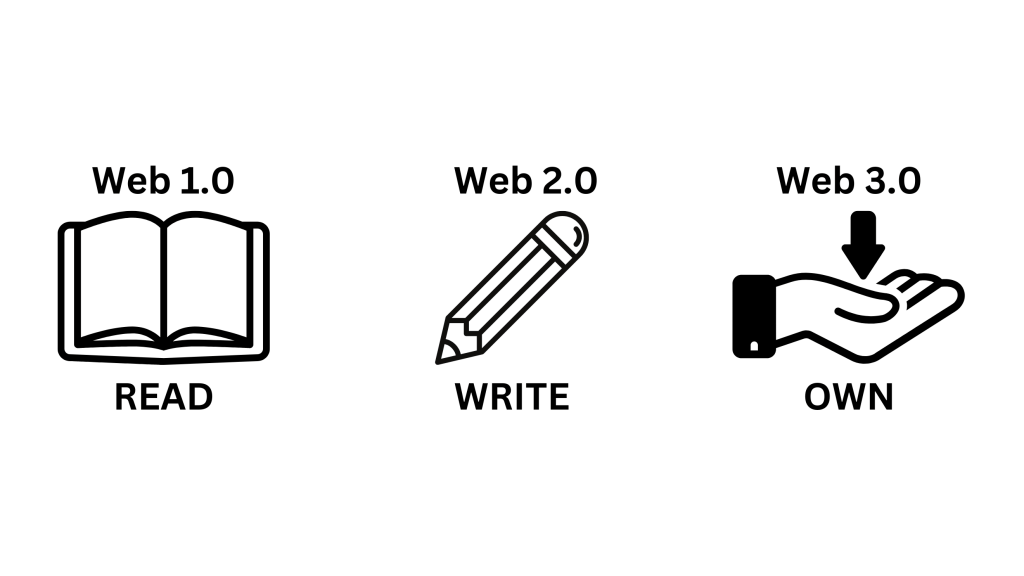

The Third Version Of The Internet

The first version was the “read-only” web of the late 80s to early 2000s. Static web pages, centralized content, limited interactivity, and personalization were the features of this initial Internet era, primarily used for information retrieval. From here, the internet shifted into a “read-write” web. People were connected through the internet and could now communicate back and forth. User-generated content, collaboration, and personalization were the main features of this social media era. Web3 takes it a step further and is seen by many as the next version of the internet.

Web3 allows people to own digital assets on the internet using blockchain technology. Assets placed on the blockchain, through a process called minting, are verified by a set of validators of a blockchain network to confirm the legitimacy of each transaction and record it on-chain. These validators are usually a mix of individuals and organizations running nodes within the ecosystem that agree with each other through a consensus mechanism to validate each transaction. Validators are incentivized to process the transaction through gas fees, tokens used to pay for a transaction to be processed. Web3 leverages decentralized networks to create a more open, transparent, and user-centric version of the Internet not controlled by large corporations.

Inside each ecosystem are decentralized applications or DApps built on top of the underlying blockchain infrastructure. These DApps serve a specific purpose within the blockchain’s ecosystem and facilitate transactions through the use of smart contracts, which are decentralized code-based agreements that are executed when a transaction is triggered by a user. These smart contracts help create trustless interactions that are immutable and tamper-proof once it’s written on the blockchain. There are numerous use cases and categories for DApps, but Decentralized Finance (DeFi), or financially focused DApps, and blockchain gaming, DApps that provide gaming experiences, are the most common.

Digital assets can be found and used within each of the blockchain ecosystems and DApps. These assets are held within digital wallets specifically designed to interact with DApps and blockchain networks through smart contracts. The two most popular digital assets in blockchain ecosystems are Cryptocurrencies and Non-fungible tokens (NFTs). Cryptocurrencies are the tokens that represent the underlying blockchain, a stable fiat currency, a DApp, or utility within a DApp, and many more. NFTs can practically represent anything from real-world items to digital assets, and even intellectual property. Prices of these digital assets fluctuate. This creates an opportunity for people to earn but also exposes them to a high level of risk.

Entering The Decentralized Web

The value of cryptocurrencies is directly tied to the underlying project it is associated with, and its use case within that ecosystem. Those looking to capitalize on the volatility of these assets but don’t want to interact with their Web3 ecosystem have the option to trade cryptocurrencies on a centralized exchange and try to make a profit off of the price changes of these digital assets. Examples of centralized exchanges with a virtual currency exchange license in the Philippines include Coins.PH, Philippine Digital Asset Exchange (PDAX), Maya, Moneybees, and more. Cryptocurrencies you can trade on centralized exchanges will depend on which ones are listed on the platform.

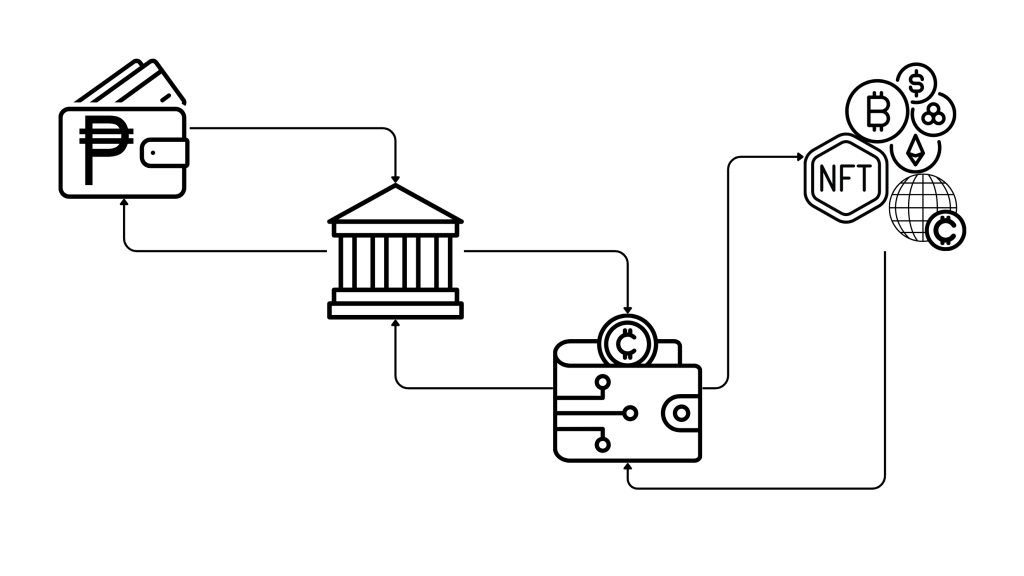

Those who want to interact with the blockchain ecosystem should first set up a wallet that can connect to the decentralized network they are trying to enter. Though there are now wallets that are created using email sign-ins, most Web3 wallets still require users to safely store their seed phrase, or secret recovery phrase, to sign in to their wallet from a new device. It is crucial to never share this seed phrase with anyone as this gives people access to your wallet. Metamask, Ronin, and Phantom are examples of hot wallets, or wallets directly linked to the internet, while Ledger and Trezor are examples of cold wallets or offline wallets. Users opt to use the latter for added security as a physical action is needed before a wallet triggers a smart contract interaction.

The next step after setting up the wallet is to transfer funds into that wallet in order to pay for the various transactions that we will be doing. This is where different onramp providers come in. These are the companies that convert your fiat currencies into a corresponding cryptocurrency that is stored in your wallets. Think of it like foreign exchange transactions necessary whenever we visit a different country. Centralized exchanges usually offer this service and can send funds directly to your Web3 wallet. Wallets also have partner service providers that are in charge of these transactions. Metamask, for example, allows Filipinos to purchase crypto using Gcash, Maya, GrabPay, ShoppeePay, Credit or Debit cards, or through banks like Unionbank, BPI, and RCBC.

One suggestion is to purchase the main cryptocurrency of the network you’ll interact with most. This is usually the currency that is used to pay the gas fees when processing a transaction. Essentially, Interaction with the different DApps is now possible once funds are inside the wallet. Most DApps would require the use of their currency to use that DApps’ services. Most decentralized exchanges, exchanges found inside the blockchain ecosystem, have trading pairs to swap currencies already inside your wallet into a currency that would allow you to use the DApp. An example of these DApps within the Ethereum network is Uniswap. Just keep in mind that each transaction on the blockchain has an associated cost to it.

After hopefully growing the funds by interacting with various DApps in the blockchain network, the next step is to understand how to convert these hard-earned cryptocurrencies back into fiat. Think of it as converting arcade tickets into prizes, but the prize is essentially cash. The first step is to send the cryptocurrency back to a centralized exchange, ensuring that the exchange supports the currency that will be sent. Next is to use the features of that exchange to convert the cryptocurrency into fiat and then send it to a bank of choice.

Having more options to onboard and offboard to and from the decentralized internet is a positive sign that more institutions are recognizing blockchain and Web3. Do not forget to do your own research when it comes to the different DApps or projects you will be interacting with. Stay safe and good luck on your web3 adventure!