The Bitcoin halving, integral to the protocol since its inception in 2009, reflects a deliberate design choice by Satoshi Nakamoto. With a capped supply of 21 million, Bitcoins are mined, rewarding participants for transaction verification. Halving, occurring approximately every four years or every 210,000 blocks, halves the reward per new block (currently 6.25 Bitcoins), gradually slowing new Bitcoin creation until the cap around 2140. Three past halving events transpired on January 28, 2012, July 09, 2016, and May 11, 2020, with the fourth slated for April 19, 2024.

While these events generate short-term market interest, their lasting impact depends on factors like market demand and broader economic conditions. This report delves into the repercussions of Bitcoin halving on the crypto market and explores its connections with the global financial landscape. By evaluating Bitcoin’s potential and risks, we aim to shed light on its evolving role as an emerging asset class.

Bitcoin Halving Impact on Cryptocurrency Markets

Investors

Observing past halving events, a key lesson for investors is the importance of patience and avoiding greed. While Bitcoin consistently reaches new all-time highs after each halving, the time taken to achieve these highs increases, accompanied by lower multiples. For instance, after the first halving, it took 371 days for Bitcoin to reach an all-time high with a 100x multiple. Subsequent halvings took 525 days with a 29x multiple and 546 days with a 7x multiple, as illustrated in the graph below.

| Days to reach ATH | Multiples | |

| First Halving | 371 | 100x |

| Second Halving | 525 | 29x |

| Third Halving | 546 | 7x |

The growth of wallet addresses has been remarkable since Bitcoin’s launch, with non-zero balance wallets surpassing 50 million and wallets holding over 1 Bitcoin exceeding 1 million. However, the number of whale wallets (with balances over 100 or 1,000 Bitcoins) has decreased post the last halving.

Trader

As the fourth halving approaches, trading activities are gaining momentum. The average daily spot trading volume, currently around US$25 billion, suggests an active market but still below the levels of the previous bull run. While the spot trading volume gradually rises from the last bear market, Bitcoin’s price remains close to the previous all-time high. Anticipation around the upcoming halving and increasing crypto adoption is expected to stimulate more trading activities.

Bitcoin halving introduces new narratives to the ecosystem, generating fresh user activity. Historically, the number of active Bitcoin addresses stabilizes before each halving, experiencing a surge afterward. This time, the focus is on BTC’s Layer 2 (L2), with numerous related projects expected to launch, contributing to a new wave of user growth.

In anticipation of the halving, exchange balances have hit a new low since the last halving event, currently standing at 2.31 million Bitcoins (11.02% of the total supply), indicating reduced selling pressure.

Miner

Miners face survival challenges, evident in the rapid depletion of Bitcoin balances in their wallets before each halving. The upcoming halving, expected in April 2024, follows a trend that started in 4Q2023, with miners continuously selling Bitcoins, resulting in the current balance reaching levels not seen since June 2021.

Miners’ revenue, despite block reward reductions, heavily relies on Bitcoin price performance. Fortunately, the total revenue has rebounded considerably from the last bear market due to the increased price of Bitcoin.

Bitcoin Halving Insights into Global Financial Dynamics

Bitcoin Outperformance among Major Asset Class

The historical returns by asset class from 2012 to 2023, depicted in the graph below, highlight Bitcoin’s consistent emergence as the best performer in 9 out of the 12 years. Despite this outperformance, an intriguing pattern emerges where Bitcoin transitions to the worst-performing asset class in the second year following halving events (e.g., 2014, 2018, and 2022). This underscores the complex dynamics surrounding Bitcoin’s performance in the broader financial landscape.

Bitcoin‘s High Correlation with S&P

Over a 1-year period, Bitcoin exhibits a high correlation (0.85) with the S&P 500, while maintaining a slightly negative correlation with the U.S. Dollar and crude oil prices, as illustrated below. Notably, entering the end of 2023 and the beginning of 2024, the rolling 90-day correlations between Bitcoin and key asset classes such as Gold, S&P 500, and Core Bond have all surged to nearly 1.0, signifying an intensified relationship.

Lower Volatility in Bitcoin Price

Despite its historical reputation for volatility, Bitcoin’s 1-year annualized volatility has experienced a clear downtrend. This trend is attributed to the increasing adoption of Bitcoin by institutional investors, fostering greater market efficiency and subsequently reducing volatility, as depicted in the graph. The evolving nature of Bitcoin’s volatility positions it as a maturing and more stable asset class compared to traditional equities and fixed income.

Bitcoin ETFs Witness Strong Net Inflow

Since the introduction of Bitcoin spot ETFs on U.S. exchanges on January 11, the ten launched Bitcoin ETFs have collectively garnered a remarkable net inflow, surpassing US$4.87 billion in just over a month. Notably, Grayscale’s GBTC stands as an exception, experiencing continuous outflows during this period.

As illustrated in the graphs below, excluding Grayscale, other Bitcoin ETFs demonstrate consistent inflows, with standout performers being iShares Bitcoin Trust (IBIT) by BlackRock and Fidelity Wise Origin Bitcoin Fund (FBTC) by Fidelity.

BTC ownership gradually decentralized

Overall, about 30% of the total Bitcoin supply has now been identified. Among them, exchanges like Binance, Bitfinex, and Coinbase hold over 1.8 million BTC combined, accounting for over 8.8% of the total Bitcoin supply. Public companies hold about 385,000 BTC total, with MicroStrategy holding 190,000 BTC, making up 0.9% of the Bitcoin supply. Institutional funds have also accumulated a large number of BTC, holding over 850,000, with Grayscale Bitcoin Trust being the largest holder with over 450,000 BTC.

Rising Crypto Adoption by institutional funds

In the realm of crypto exposure and hedging, derivatives serve as pivotal tools for both investors and speculators. While futures perpetual contracts dominated the market in recent years, a noticeable shift has occurred, with options gaining significant traction since 2Q2023, as depicted in the graph below. This surge in options’ open interest, surpassing that of futures perpetual, signals a changing landscape. Anticipated positive trends in derivative market activities are attributed to the forthcoming halving event and the escalating adoption of crypto, extending beyond retail investors to institutional funds.

Optimizing Portfolio Performance with Bitcoin Allocation

CoinEx research team carried out a backtest on the performance of a traditional 60/40 portfolio compared with multiple scenarios of Bitcoin allocation. The results clearly indicated that adding Bitcoin, even with a single-digit allocation, would greatly enhance not only the equity curve, but more importantly the portfolio’s risk-adjusted return. The detailed analysis is outlined in the below table.

Risk diversification is key to portfolio management. In fact, backtest results reveal that even a 1% allocation to Bitcoin could enhance the risk-adjusted return, or the Sharpe ratio, of the portfolio. A 5% allocation to Bitcoin results in a further enhancement of the Sharpe ratio, but the impact on the portfolio’s volatility or the maximum drawdown is limited.

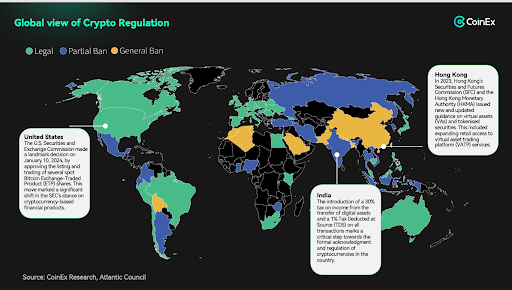

Crypto regulation formalized

Countries across the globe have different attitudes towards cryptocurrencies, including Bitcoin. Some, such as the United States, Canada, and Brazil, treat it as legal tender and provide a robust regulatory framework, offering more transparency and protection for cryptocurrency investors. Meanwhile, countries like Iran and Russia have imposed some restrictions on cryptocurrencies. In Asia, Hong Kong has introduced cryptocurrency-friendly policies and regulations in recent years, indicating that the level of government recognition in this field is gradually increasing.

Final thoughts

The impact of Bitcoin on both crypto and global financial markets is profound and intricate. Historical analyses reveal that halving events consistently attract heightened market attention, propelling Bitcoin to new price highs. However, the observed deceleration in the pace and growth multiplier of these increases underscores the evolving nature of the cryptocurrency landscape. The surge in wallets with non-zero balances and the decline in whale numbers indicate a broader embrace of cryptocurrencies.

Furthermore, halving events serve as catalysts for new narratives, increased user engagement, and the launch of associated projects, contributing to sustained growth within the Bitcoin ecosystem. This dynamic environment reflects the maturation and expansion of the cryptocurrency space.

In the realm of global financial markets, Bitcoin’s performance is intricately connected to global liquidity, displaying a notable correlation with other asset classes, and witnessing a surge in institutional investor adoption. Despite regulatory hurdles, Bitcoin is progressively gaining recognition and investment from institutional funds, solidifying its standing as a legitimate and influential player in the broader financial landscape. The multifaceted dynamics of Bitcoin’s impact underscore its role as a transformative force shaping both crypto and global financia